- DraftKings has been considered one of the more successful deals in a recent wave of SPAC transactions marred by scandal and bad actors. Its stock is up ~398% from its announcement price.

- The company went public in a 3-way merger between (1) DraftKings, (2) its SPAC sponsor, and (3) a Bulgaria-based gaming technology company called SBTech.

- SBTech accounted for ~25% of total revenue at the SPAC consummation and was the only positive contributor to operating income, providing both financial stability and technology to the deal.

- Unbeknownst to investors, DraftKings’ merger with SBTech also brings exposure to extensive dealings in black-market gaming, money laundering and organized crime.

- Based on conversations with multiple former employees, a review of SEC & international filings, and inspection of back-end infrastructure at illicit international gaming websites, we show that SBTech has a long and ongoing record of operating in black markets.

- We estimate that roughly 50% of SBTech’s revenue continues to come from markets where gambling is banned, based on an analysis of DraftKings’ SEC filings, conversations with former employees, and supporting documents.

- As one former employee told us, DraftKings’ subsidiary SBTech has “sold to plenty of mobs”, a sharp contrast to the clean image of DraftKings’ brand-conscious partners, including the NFL, NBA, NASCAR, UFC and PGA, and the company’s recent hire of supermodel Gisele Bundchen to advise on governance issues.

- Prior to the SPAC merger, SBTech seems to have made a concerted effort to distance itself from its black-market dealings. Illicit customer relationships were shuffled into a newly formed “distributor” entity called BTi/CoreTech, with ~50 SBTech employees shifted across town to the new entity.

- The CEO selected to run BTi/CoreTech was formerly an executive of a ‘binary options’ gambling firm raided by the FBI and subsequently charged by the SEC for deceiving U.S. investors out of over $100 million.

- Former SBTech employees called BTi/CoreTech a “front”, and said the split preserved SBTech’s (and now DraftKings’) illicit business while shielding the public company from scrutiny. For all practical purposes, it appears that BTi/CoreTech functions as DraftKings’ undisclosed illegal gaming division.

- We identified numerous black market clients of DraftKings’ “front” entity, through searches on social media and back-end web infrastructure. For example, an Asia-focused site tied to a triad kingpin at the center of a Swiss money laundering investigation advertises its use of BTi/CoreTech technology.

- In 2019, Vietnamese authorities arrested 22 individuals involved in a “massive illegal online sports betting ring” linked to BTi/CoreTech’s platform.

- Contrary to representations made to Oregon’s state lottery, a former employee told us SBTech had extensive operations in Iran, violating local laws in a market subject to heavy U.S. sanctions. We were told SBTech knowingly operated there for 4-5 years with the founder directly overseeing the operation.

- Around the time of the DraftKings deal, SBTech’s founder spun off another gaming brand that also operated in markets where gambling was banned, transferring it to his brother. The brand was behind a “massive Chinese operation”, according to a former employee, contrary to representations made to Oregon’s state lottery.

- The brand continues to operate in China despite the strict local rules prohibiting online gambling, according to our review of web infrastructure for multiple China-facing gambling sites. DraftKings continues to transact with the entity, according to SEC filings.

- DraftKings trades at a ~26x last twelve months (LTM) sales multiple and a ~20x estimated 2021 sales multiple despite (i) no expectation of earnings for years, (ii) intense competition, and (iii) regulatory risk. The company posted net losses of $844 million in 2020 and $346 million last quarter.

- Insiders have dumped over $1.4 billion in stock since the company went public a little over a year ago, with SBTech’s founder leading the pack, having personally sold ~$568 million in shares.

- Despite a rocky track record prior to taking DraftKings public, the company’s SPAC sponsors ultimately received 9.3 million shares, worth around $114 million at the time, in exchange for a token $25 thousand contribution.

- We spoke with several industry experts and competitors who questioned the viability of DraftKings’ model of aggressively burning cash on promotion and marketing to acquire customers in the near term, despite a lack of evidence of long-term customer brand loyalty.

- We think DraftKings has systematically skirted the law and taken elaborate steps to obfuscate its black market operations. These violations appear to be continuing to this day, all while insiders aggressively cash out amidst the market froth.

Initial Disclosure: After extensive research, we have taken a short position in shares of DraftKings, Inc. This report represents our opinion, and we encourage every reader to do their own due diligence. Please see our full disclaimer at the bottom of the report.

Introduction And SPAC Merger Background

Amidst a SPAC boom that has been riddled with bad actors and deception, DraftKings has been considered one of the more successful names to go public via the blank check method.

Its stock is up ~398% since its deal announcement, fueled by retail enthusiasm over recent deregulation in the gambling market and helped in large part by its clean corporate image.

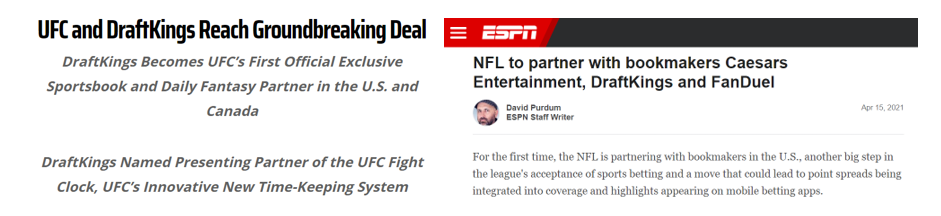

In the often-murky world of global online gaming, DraftKings has harnessed its reputation to ink major deals with the most well-known sports partners in the United States, including the NFL, NBA, NASCAR, PGA and the UFC.

The company also hired a number of high-profile advisors, including Baseball Hall of Fame inductee Cal Ripken, Jr. and basketball legend Michael Jordan. Most recently, it even announced that supermodel Gisele Bundchen had been hired as special advisor to the CEO to “advise on environmental, social, and governance initiatives.”

DraftKings began in 2011 as a fantasy sports website before making the transition to full-scale online betting house following a 2018 Supreme Court decision that legalized sports gambling in the U.S. [Pg. 65] It then used its Daily Fantasy Sports brand to launch its first sportsbook offering in August 2018 in New Jersey, shortly after state law permitted the practice.

The company’s Wall Street story started when it went public on April 24th, 2020 in a 3-way merger between (1) DraftKings, (2) its SPAC sponsor, and (3) SBTech, a Bulgaria-based technology company founded in 2007 that develops back-end infrastructure for online gaming companies. [Pg. 55]

While DraftKings received more public attention as the face of the brand, SBTech played a crucial role in the company’s go-public deal, serving as the company’s technological and financial backbone. It accounted for ~25% of DraftKings’ revenue and was the only positive contributor of operating income, helping stabilize the financial offering for the market. [Pg. 165] The deal made SBTech founder (and now DraftKings director) Shalom Meckenzie the single largest DraftKings shareholder. [Pg. 169]

As DraftKings’ consumer business has grown, SBTech’s business-to-business (“B2B”) revenue now comprises about 10% of total revenue and still provides a modest positive EBITDA contribution for the otherwise loss-generating company. [Pg. 15]

Total consideration paid for SBTech was $975 million, representing ~21% of the total merger consideration. [Pg. F-22, Pg. 57]

The SPAC consummation created, in DraftKings’ words, “a vertically-integrated powerhouse” for sports betting.

Priced For Perfection: A ~20x Forward Sales Multiple Despite No Near-Term Expectation of Earnings and Significant Regulatory Hurdles in the Budding Sports Betting Market

Insiders Have Dumped Over $1.4 Billion in Stock Since Going Public Just Over a Year Ago

DraftKings trades at an extremely rich valuation of ~26x LTM sales/20x estimated ‘21 sales, despite no expectations of earnings until at least 2025 (the furthest out estimates go), according to FactSet’s consensus analyst estimates.

Its $21 billion valuation matches all of the following key competitors, combined:

- FanDuel, its closest peer and major competitor, was valued at $11.2 billion in its most recent private market investment round in December 2020.

- Wynn Interactive, a growth asset being spun off from Wynn Resorts with 13+ million customers with a $3.2 billion valuation.

- Supergroup, viewed as having a high quality global sportsbook asset, best-in-class margins, and free cash flow generating assets, with a $5.1 billion valuation.

- Kambi, a publicly-traded sports betting technology competitor operating on 6 continents, with a $1.5 billion valuation.

DraftKings’ extraordinary valuation is largely owing to investor enthusiasm over the budding online gaming industry and the potential for further state regulatory easing.

In short, the market is pricing in perfect execution of a business with a stellar brand in a new market subject to intense competition and fraught with regulatory uncertainty. As we will show, we think the company is standing on several landmines that will inhibit its ability to fulfill the market’s lofty expectations.

Insiders seem to share this view, having already sold over $1.4 billion in shares since the company went public a little over a year ago, according to Bloomberg data sourced from SEC filings. SBTech founder Shalom Meckenzie has led the pack, unloading ~$568 million in shares personally:

Several weeks ago, Meckenzie transferred 19 million shares to a trust for his spouse and kids, paving the way for them to dispose of ~$1 billion in stock without the same reporting requirements he would be subject to.

Part I: The “Front Company” That Masks DraftKings’ Dealings in Black Markets And Connections To Money Laundering and Organized Crime

SBTech offered DraftKings a turnkey sportsbook, complete with user management, customer support, and payment gateways. [Pg. 226]

It also looks to have exposed DraftKings shareholders to extensive black market dealings, money laundering and organized crime.

We estimate that roughly half of SBTech’s 2020 revenue came from black or unregulated markets, based on our review of SEC filings and discussions with former employees, as detailed below.

Unlike many software businesses that just charge flat or per-user fees, gaming businesses like SBTech partner with their client base through revenue share arrangements. SBTech collected between 10-30% of revenue, depending on the jurisdiction and nature of the services, according to multiple former employees we spoke with.

Overall, black market operators were charged a higher fee, the former employees told us, due in part to the elevated risks involved in operating in such jurisdictions.

2014: SBTech’s Entrance Into Black Markets in Asia

SBTech was founded in 2007 by Shalom Meckenzie as a sports betting technology provider.

According to former employees, SBTech’s offering struggled to compete against competitors like Kambi, which had a robust team dedicated to analyzing and setting “in-game” betting odds and had more powerful technology. The competition pushed SBTech to seek business in markets where others were unwilling to operate, we were told.

Despite the illegality of sports gambling in major Asian markets, SBTech’s own marketing materials suggest it had an expansive Asia-facing business at least as far back as 2014. SBTech’s website at the time advertised a “powerful turnkey Asian system” that accepted payment in currencies where gambling was clearly illegal.

Specifically, according to the graphic on its website, SBTech accepted Vietnamese Dong and Indonesian Rupees – both currencies based in black market sports gambling jurisdictions. [1,2]

As we will cover in Part 2, we also spoke with former employees that explained how SBTech operated in Vietnam, Thailand, and Malaysia, and countries like Iran, a black market that has regularly been subject to U.S. sanctions.

We found evidence of SBTech’s involvement with multiple operators that were specifically linked to illegal gaming ring raids in Vietnam and Thailand.

2015-2018: SBTech’s Asia Business is Run By Tom Light, The “Right Hand Man” To the SBTech CEO

SBTech’s Asian facing business was being run by the company’s head of international business development, Tom Light (also known as Tom John Or-Paz).

A former SBTech employee described Light to us as SBTech founder Shalom Meckenzie’s “right-hand man”. He said that Light was “4 out of 5 reasons” why Meckenzie is who he is, noting Light’s ability to network with black and grey market operators to grow SBTech’s business.

Light is seen promoting SBTech’s Asian platform at a 2015 conference, stating that SBTech has a “full Asian facing product” and is “very rooted in Asia” with “dozens if not hundreds” of other sports betting clients on the continent.

2017: The Asian Business is Removed from the SBTech Website As the Prospect of Loosening Gambling Restrictions in the U.S. Emerges

In June 2017, the Supreme Court agreed to review PASPA, the legislation federally banning sports betting, giving hope that the largest economy in the world would finally open up to the industry.

SBTech’s website removed its advertisement for Asian solutions sometime in 2017, according to internet archives.

March 2018: SBTech Announces That Shalom Meckenzie’s “Right Hand Man” Has Left The Company In Order to Start an Unnamed Company

Corporate Records Reveal The New Company Name as “BTi”, Later Renamed CoreTech

Former Employees Explain That BTi/CoreTech Was Merely a “Front” Entity Set Up To Mask SBTech’s Involvement in Black and Unregulated Markets

In December 2017, the Supreme Court heard oral arguments on PASPA. Most legal experts observing the arguments agreed that the law prohibiting U.S. sports betting would likely be repealed. [1,2,3,4]

According to a former business partner of SBTech, the prospect of doing business in the U.S. was the trigger for SBTech owner Shalom Meckenzie to spin out certain of his gambling operations to at least two separate entities. The entities were placed under the control of relatives or trusted confidantes and run by many of the same staff.

Shortly after the Supreme Court hearing, on March 19, 2018, SBTech announced that Tom Light, the SVP of business development, was leaving to create a “new blockchain and gambling venture”.

The venture was unnamed in the press release, but Maltese and Bulgarian corporate records show that Light began creating an entity called BTi days later. [1,2,3] It was later renamed CoreTech.

One former employee who served in a product development role told us BTi/CoreTech was a “front” for SBTech’s illegal or unregulated markets:

“Before SBTech joined with DraftKings, they split the grey market/unregulated…they [Bti] are a separate company marketing their white label solution to Middle East, South America, mostly China and Malaysia. Their technology provider is SBTech. Because SBTech is now on NASDAQ they don’t want Asia or the grey market to give it a bad influence. They want to be clean.”

The same former employee told us that BTi/CoreTech acted as a customer of SBTech, which invoiced BTi/CoreTech, in an apparent effort to put a layer of legal separation between SBTech and its black market end customers.

A second former employee, who worked as a data specialist at SBTech for several years, described BTi/CoreTech similarly. When asked how much of BTi/CoreTech’s revenue comes from black or grey markets he said:

“I would say almost all of it. Well over 90%”

Despite the small legal market in Asia, DraftKings states in its SEC filings that an unnamed customer focused on Asian markets accounted for 46% of SBTech’s 2019 revenue and 52% of SBTech’s 2020 revenue, but failed to disclose the name of the customer.[1] [Pg. 39, Pg. 40]

When asked about this, the former employee speculated “…if it’s Asia it will have to be (BTi)…it must be through BTi”. To be clear, SBTech has several Asia-facing customers and “resellers” such as 10Bet, W88, and Gameplay, as we detail further. The opacity of DraftKings’ customer relationship disclosures has thus far masked the names of its top customers.

The implication either way is that black and unregulated market revenue and profitability, which includes BTi/CoreTech, represented and still represents a major portion of SBTech’s financials since DraftKings went public.

The former employee added that the new focus on adding blockchain to the gambling offering was because operators in black markets had requested cryptocurrency options to make moving money easier. Crypto has emerged as the medium of choice for illicit money transfers, given the lack of oversight.

BTi/CoreTech was set up across town from SBTech’s office in Sofia, Bulgaria, 4.5 miles (7.2 km) away, per Bulgarian corporate records.

2018 (to Present): The CEO Selected to Run BTi/CoreTech Was Formerly An Executive Of A ‘Binary Options’ Gambling Firm Raided By The FBI and Subsequently Charged By The SEC For Deceiving U.S. Investors Out Of Over $100 Million

With SBTech’s “front” entity created, the right leadership needed to be put in place to manage its illicit clientele.

The CEO leading BTi/CoreTech since its inception is Amir Vaknin, according to his LinkedIn profile and Bulgarian corporate filings.

Immediately prior to BTi/CoreTech, Vaknin served as CTO and later claimed to be CEO of disgraced binary options gambling platform SpotOption between 2011 to December 2017 – a company subsequently charged by the SEC with defrauding U.S. investors out of at least $100 million.

SpotOption was raided by the FBI in 2017 as part of investigations into overseas “binary option” scams. [2] The company was alleged in an FBI affidavit to have provided the backend software for such scams, which included using the software to increase the likelihood that its high-roller clients lost money on their bets.

SpotOption was subsequently charged by the SEC with defrauding U.S. investors out of at least $100 million.

Vaknin previously included SpotOption on his LinkedIn profile, per earlier screen captures, but he has since removed it.

Notably, fellow BTi/CoreTech director and senior employee Maxim Slavutsky also worked with Vaknin at SpotOption.

BTi/CoreTech´s founder, Tom Light, offered his services as consultant to the binary options industry, which Israeli media has referred to as “a fraudulent industry”. The range of his consultancy services can be seen via archived internet pages. The live page seems to have been removed sometime after March of this year.

Israel´s parliament voted to ban overseas trading in binary options in 2017. The Times of Israel hailed the decision with the following headline:

With its leadership plucked from the “fraudulent” binary options industry, BTi/CoreTech was ready to begin absorbing SBTech’s illicit operations.

Mid-2018: Following The U.S. Supreme Court’s Repeal of Online Gambling, SBTech Employees Started Shifting To “Front” Entity BTi/CoreTech In Advance of a U.S. Deal

On May 14, 2018, PASPA was formally repealed by a Supreme Court decision, paving the way for state-sanctioned sports betting. Following the repeal, SBTech’s transfer of operations to the 4-month-old BTi/CoreTech entity looked to have been in full force.

Bulgarian employment records show that in July 2018, SBTech reported a reduction in employee headcount by 47. That same month, BTi/CoreTech reported its first employee headcount at 50.

These employee transfers are corroborated by multiple LinkedIn profiles showing employees transitioning from SBTech to BTi/CoreTech in mid-2018. [1,2,3,4,5,6,7,8,9]

2019: SBTech’s Founder Met With DraftKings’ CEO To Discuss The Merger

Two Days Later, BTi Changed Its Name To “CoreTech”, Muddling the Relationship Further

The first meeting to discuss a combination of DraftKings and SBTech happened between SPAC sponsor Harry Sloan, DraftKings CEO Jason Robins, and SBTech‘s Shalom Meckenzie in Israel on June 15th, 2019, according to deal documents. [Pg. 95]

Two days later, on June 17th 2019, BTi changed its name to CoreTech.

Despite SBTech’s Claims That The Entities Are Separate, Multiple Employees And Customers Described BTi/CoreTech As Either An Affiliate or Subsidiary Of SBTech, or Used The Name BTi Interchangeably With SBTech

Despite the ostensible separation, many employees seemed to be under the impression that they worked for SBTech.

This includes BTi/CoreTech’s current CEO, Amir Vaknin (who, according to his LinkedIn, never worked for SBTech). Nonetheless, he announced he was searching to hire employees for SBTech around the time that BTi/CoreTech was formed.

Other employees were under the impression that BTi/CoreTech was a direct affiliate or subsidiary of SBTech. A former BTi/CoreTech developer, for example, stated in his online resume that BTi is an SBTech company.

Another online resume shows a senior employee working concurrently as Head of Bulgaria operations at SBTech and Finance Director at BTi.

Yet another LinkedIn resume shows an employee who claims to have worked at both companies concurrently from July to November 2018.

The muddled relationship is visible through customer communications as well. After BTi/CoreTech launched, it was advertised in Asian markets as being SBTech. An Asian white label provider called GamingSoft described BTi as being founded in 2007 (which was actually the year SBTech was founded) and simply ran the SBTech commercial to describe BTi’s services.

Another betting review site used BTi/CoreTech and SBTech interchangeably.

In a somewhat odd instance, we identified a site operated under a different domain that claimed to be BTi/CoreTech and identified the company as being part of SBTech Group:

We reached out to BTi/CoreTech to ask about the site and were told it was “an old copy of ours” and a “fake” that they had nothing to do with. We asked how it could be both a copy and a fake. Within roughly an hour of our inquiry to BTi/CoreTech, the site was completely deleted.

Despite clear evidence of a tight connection, former employees who had worked at both SBTech and BTi/CoreTech, were generally defensive, guarded, and evasive when asked about the relationship between the two companies.

One BTi/CoreTech manager told us:

“(BTi) CoreTech is not a part of SBT group. We are competitors currently operating on different markets. Regarding the colleagues, we all do search for good opportunities and some people find SBT attractive, some find CoreTech more attractive.”

But a different former colleague we spoke with acknowledged SBTech had in fact set up BTi/CoreTech:

“Till full separation of few months, SBTech supported BTi, but the split was handled in less than 3 months.”

Finally, yet another employee who has worked for both SBTech and BTi/CoreTech, offered more specifics after initially saying they could not speak because such information was “classified”. They told us:

“BTi/CoreTech acts as an agent or distributor for SBT while the two companies are very financially close. The core system is developed by SBT and BTi/CoreTech is its distributor in Asia…It´s mostly sportsbooks… China and SEA (south-east Asia) are the two biggest markets (for BTi/CoreTech). Especially SEA where football is a big scene there.”

They said that BTi/CoreTech neither sold nor distributed any other products except the platform supplied by SBTech:

“All CoreTech business comes from SBT.”

Part II: SBTech/BTi/CoreTech’s Ties To Black Market Operators And Suspected Organized Crime

As indicated by multiple former employees, the reason for all of the administrative shuffling – the renaming and re-branding of parts of SBTech to BTi to CoreTech – was an effort to separate the entity’s “behind the scenes” black market operations to pave the way for a U.S. deal partner like DraftKings’, with its polished and clean exterior.

We have been able to corroborate many of these claims through documents and web sources, detailing BTi’s involvement with operators that were specifically linked to illegal gaming ring raids in Vietnam and Thailand.

Example 1: BTi’s Sportsbook Is Advertised Through a Site Linked To A Recent Raid on An Alleged Illegal Operator in Thailand

We discovered BTi’s sportsbook running on a Betway branded gaming site targeting Thai and Chinese players.[3]

The Betway site offers a sportsbook in three languages: Thai, Mandarin and English. However, online sports betting is banned in Thailand and China.

The Thailand-facing Betway branded operator displays BTi’s logo on its website, advertising the relationship.

The site’s backend web infrastructure also makes multiple references to BTi. A search of the site’s network shows multiple URL requests targeting “BTI”.

In February 2021, Thai authorities in the Chanthaburi province raided an alleged illegal gambling operation run out of 4 converted shipping containers. The operators administered 4 websites facilitating Thai gambling, including a site called “betway88”. Authorities arrested 34 people in connection with the raid.

We have reached out multiple times via email and LinkedIn message to Betway´s head of corporate communications for clarification on Betway´s role in this incident but have so far received no response.

Example 2: 12Bet, A Site Tied To Triads And At The Center Of A Swiss Money Laundering Investigation, Advertises Its Use of BTi’s Technology

SBTech and BTi are also tied to an Asian operator called 12Bet that was recently linked to a police raid in Vietnam and is rumored to be owned by a triad gang kingpin.

BTi’s sportsbook appears advertised by 12Bet on multiple Asian facing websites. [1,2,3]

For instance, the below 12Bet mirror site clearly advertises BTi’s sportsbook, and displayed open communications with BTi’s site, as shown in the developer tools below. (A mirror site is essentially a replica site, that is often set up internationally to either skirt local restrictions, or as a backup in case one site gets shut down by regulators.)

In 2015, Vietnam authorities shut down an illegal gaming ring tied to 12Bet.

It was alleged earlier that “tens of millions of U.S. dollars” from losing Vietnamese gamblers were being transferred to the owners of 12Bet.com, according to gaming news site Pokertube.

Gambling for Vietnamese citizens is almost entirely banned currently, with prison sentences for operators and fines for gamblers being common. The only exception is a state-owned lottery.

In addition to apparent black-market bookmaking, 12Bet is or was owned by Paul Phua, according to an investigation commissioned by the Swiss IHAG Bank. The U.S. Department of Justice has alleged that Phua is a senior member of the 14K Triads, one of the most dangerous criminal syndicates in the world, known for heroin smuggling and contract murder, among other activities.

Links to Phua landed 12Bet at the center of a Swiss money laundering investigation related to the Triad member’s various laundering entities.

Example 3: Gaming Site Fun88, Linked To An Illegal Gaming Raid In Vietnam, Also Advertises Its Use of BTi’s Platform

In early 2019, Vietnamese authorities arrested 22 individuals in what was described as a “massive illegal online sports betting ring linked to the Fun88 brand.”

Authorities said U.S. $1.28 billion in wagers were processed by the ring, flowing through the Vietnamese intermediary tied to Fun88.

Around 4 months before the raid, a former BTi/CoreTech employee posted a photo on Twitter showing a holiday gift basket sent from Fun88 to BTi.

In addition to holiday treats, other links between the two entities include Fun88 advertising BTi on a Vietnamese facing site.

Example 4: SBTech Claimed to Oregon Regulators That Its Customer 10Bet Did Not Derive Revenue From China (A Major Black Market) Using SBTech’s Software

We Found Multiple Chinese-Facing 10Bet Sites Where Backend Web Infrastructure Demonstrates SBTech’s Involvement

Online gambling in China has been illegal for years, and has faced recent harsh crackdowns. China arrested over 11,500 people on suspicion of cross border gambling in a series of raids last year, for example.

SBTech’s first major contract in the US was providing its sportsbook to Oregon’s Lottery Commission in 2019. During the vetting process, the Oregon State Lottery wanted to know more about a company SBTech had a relationship with called “10Bet” that seemed to operate in China, based on documents we received through a public records request.

In the Oregon state lottery report, excerpts were included from a letter from Richard Carter, SBTech’s then CEO. Carter wrote that 10Bet was an independent brand that “does not derive revenues from China using SBTech’s software”. The statement is followed by a paragraph explaining that a different operator has the right to use 10bet’s brand in Asia, and that operator is a sublicensee of one of SBTech’s distributors.

A former SBTech employee familiar with the Oregon contract told us that SBTech in fact had a massive China operation, contrary to representations made to the state of Oregon:

“Call it what it is, they were running a massive Chinese operation and BTi was the holding corp. that they had it in, and yes Shalom [Meckenzie] is still taking money out of it, and yes that’s the risk.”

Supporting this statement, we found multiple 10bet China facing sites that currently contain source code indicating that they are running SBTech software. This suggests that SBTech’s representations to state regulators were false. It also suggests that DraftKings continues to collect revenue through 10bet’s black market operations.

Below is one of 5 instances where source code that appears tied to SBTech’s BTi/CoreTech is pulled from Chinese betting sites.

We also found source code elements that indicate SBTech and BTi/CoreTech’s involvement in 5 other apparent Chinese mirror sites.

Once again, despite all the evidence above, this is what SBTech told the Oregon state lottery:

Example 4 (Cont’d): 10bet, A Sports Betting Firm With Apparent Ongoing Operations in China, Was Launched By SBTech Founder Shalom Meckenzie

In Mid-2018, Meckenzie Stepped Down From 10Bet And Transferred His Shares to His Brother To (Once Again) Obfuscate The Connection

DraftKings Continues to Do Business With the Entity, Per Its SEC Filings

SBTech’s disclosure to the Oregon state lottery described 10bet simply as “a brand” that operated primarily in Europe, suggesting it was like any other independent company.

The full picture is less clear cut. Rather than merely being an independent brand, 10Bet was actually founded and run by SBTech founder Shalom Meckenzie since its inception, according to UK corporate records.

Meckenzie then stepped down as a director in 2018, per the same records, and later transferred “the rights and everything related to the 10Bet brand” to an entity owned by Water Tree Limited, whose sole owner is Meckenzie’s brother, Roy Meckenzie, per a former employee and DraftKings’ SEC filings. [Pg. 176]

The relationship appears to be ongoing. DraftKings discloses related-party business with Roy Meckenzie and Water Tree in its filings (without ever actually naming the 10Bet brand or the apparent illegality of some of its ongoing Asian-facing operations). [Pg. 308]

A former employee explained to us that the transfer was yet another legal fig leaf meant to separate SBTech from some of its prior operations in order to enter U.S. markets, while still keeping control of the entity in the family:

“For SBTech to pass their due diligence with DraftKings, one of the points was they were told they could not operate a B2C brand and not hold data of white label other brands because it was competition, and so there was conflict of interest. And so in order to resolve that, SBTech needed to separate 10bet the brand out of SBTech one way or another.”

Example 5: SBTech Operated in Iran For Years, According to Multiple Former Employees, Contrary to Its Representations to Oregon State Regulators

Around the time of SBTech’s deal with Oregon, a 2019 media report highlighted some of SBTech’s suspected black-market operations. Per the article:

“Online records and company gaming profiles show that businesses that use SBTech technology reach out to online customers in Iran and Turkey, where gaming is restricted or illegal yet have unregulated black market activity.”

SBTech publicly denied the claim:

“SBTech told reporters that it categorically denied operating in Iran, and thoroughly vets customers who rely on its technology.”

Many investors likely found solace in the fact that Oregon appeared to vet SBTech, even flying investigators to Bulgaria to interview multiple employees at SBTech offices, before eventually approving the deal.

Yet despite SBTech’s public denials, the company admitted privately to the Oregon Lottery that it did have business in Iran.

Per a report we received through a public records request, during the Oregon investigation, SBTech claimed it “became aware” of one of its distributors operating in Iran, then “caused” the distributor to terminate the Iranian relationship:

Former employees described the scenario much differently. Iran had been a lucrative market, operated with the full knowledge of SBTech founder Shalom Meckenzie. Meckenzie chose to abandon the market in search of bigger business opportunities in the U.S., we were told.

The reason Iran was so lucrative, according to the former employee, was due to there being few technology options given that it was a black market and regularly subject to international sanctions:

“You want to go to take rev share off a guy in Iran, you can charge him 30% and he doesn’t really have another choice”

The former employee estimated that SBTech had done business in Iran for 4-5 years, but later dispensed with the business around early 2019 when facing scrutiny around the deal with the Oregon state lottery, given that Iran was a U.S. sanctioned country,

Note that the same Oregon lottery report describing the Iran dealings also revealed BTi as one of two key distributors, despite neither the Iranian dealings nor its relationship with BTi/CoreTech appearing anywhere in DraftKings’ public filings. [Pg. 10]

DraftKings Has Faced Questions About Its Culture of Non-Compliance Before, Including a Settlement With the New York AG Over Allegations that It “Consistently Misled Consumers”

This is not DraftKings’ first time facing questions of regulatory compliance, and appears to be part of a culture of ‘do whatever we think we can get away with’.

In 2016, the company settled with the New York Attorney general over allegations of extensive false and deceptive advertising to consumers.

Separately, a late-2020 media article detailed how DraftKings seemed to be selectively enforcing rules against betting by proxy—when bettors in states where gambling is illegal place bets through an individual in a state where it is legal, in order to skirt the ban.

Part III: Experts And Competitors Share Their View on DraftKings Business Model

Aside from its black market issues, we spoke with industry experts and competitors to assess whether DraftKings has a durable edge with either its technology or its business model.

We found that the key cited “advantage” was simply DraftKings’ willingness to generate losses by spending its SPAC money on marketing and customer acquisition in order to boost its near-term numbers.

The durability of such tactics seems questionable, as many customers seem to just chase the latest promotion. For example, BetMGM managed to capture an estimated 14% share of the national online sports betting market in the three months to February, largely through aggressive promotions.[4]

Major Sports Betting Markets Are Competitive And There’s Little That Sets DraftKings Apart Aside From Its Willingness to Spend SPAC Money on Marketing and Promotional Offerings

With 15 U.S. states legalizing online gaming and others expected to follow, the list of major competitors involved keeps growing.

There are 13 multi-state sports betting apps, and at least 40 single-state apps, according to gaming industry research provider Eilers & Krejcik Gaming.

With competitors like FanDuel, Barstool Sportsbook, Bet365, PointsBet, William Hill, FoxBet and offerings from major established U.S. casino players like BetMGM all snapping up market share, the question then becomes: what differentiates DraftKings?

Executive Director at International Center for Gaming Regulation: No Operator is Currently in a Position to Dominate

We asked Joe Bertolone, Executive Director at the International Center for Gaming Regulation in Las Vegas, about whether the environment was conducive to any individual sportsbook operator dominating:

“I think the answer right now in the next two to five years is no…In addition to the licensed US sportsbooks there are many international and primarily UK sportsbooks trying to enter the market.”

He also questioned DraftKings’ model of spending on customer acquisition:

“… one of the things we look at in Fanduel and DraftKings in particular is the questions that many in the industry have about the sustainability model. Depending on who you speak with, they spend three to five times more on their player acquisition than other companies…Can you continue to offer bonuses, sign up bonuses, promotional bonuses, marketing offerings to acquire players? And does that come with the kind of player loyalty that is required to support not only the stock price but keep sustainable and continued growth?”

Partner at Gaming Consultancy Firm Speaks About the Model of Heavy Promotion and Marketing Spend: “It’s Not Sustainable in the Long Term”

Brendan Bussmann, Partner and Director of Government Affairs at a Las Vegas based gaming consultancy, stressed to us that innovation is going to win the day after the rush to snap up early market share ends:

“People will go where the deals are and the best odds because there´s competition and options.”

We asked about the model of spending heavily on promotion and marketing:

“It´s not sustainable in the long term…I think (DraftKings is) doing what they think they have to do to get market access out of the gate and that’s their model. Whether it holds is yet to be seen because I don´t know what somebody will do in 3 to 5 years if the promos stop. Do they switch? Do they start looking?”

SVP of Publicly Traded Sports Betting Operator: Marketing Investment is Key in the Early Days. In the Long Run It’s Tech & Product

We also spoke with Manuel Stan, Senior Vice President of publicly-traded Kindred Group (Unibet). We asked him about whether he thought a single player could dominate the market as the sports betting industry evolves. He told us:

“In a well-regulated market that allows fair competition, as the market matures, we would expect to see more operators gaining significant market share and the share of the market leaders to gradually decrease.”

He also expressed to us that as the market matures, product differentiation will be the driving force behind customer adoption:

“In the early days, the marketing investment is a key driver to building the brand equity and acquiring customers…In the long run, Customer Experience (product, tech, customer support etc) will be the decisive factors, the main question is how long is the journey to that point.”

Conclusion

The SPAC boom has been defined by companies going public despite major lurking issues—whether it be fake technology (i.e., Nikola), unrealistic projections (i.e., virtually all of them), or other undisclosed landmines. Meanwhile, sponsors and insiders have been cashing out while hoping their marks—mostly retail investors—don’t notice.

One issue with partnering with black market betting operators is that such businesses are not just engaged in illegal betting. These operators almost by definition are engaged in money laundering, and often additional lines of underground business activity.

As one former employee told us succinctly, SBTech founder Meckenzie and his affiliate entities have “sold to plenty of mobs”.

The same former employee explained that DraftKings and its SPAC sponsors must have either known the issues with SBTech’s black market operations or were grossly negligent in their diligence:

“I would be really, really, really surprised if they didn’t know. In fact, it would be really, really amateur of them if they didn’t investigate that. Presumably they knew and…helped facilitate hiding it or turned a blind eye to it… but they must have known.”

DraftKings has never identified the nature of its BTi/CoreTech relationship in any of its SEC filings – not as an affiliate or subsidiary of SBTech or in any other way as relevant to DraftKings’ SPAC combination with SBTech. It also has not provided transparency regarding the markets SBTech and its other “resellers” and affiliates operate in, and their respective contributions to the public company.

Given the importance of SBTech to DraftKings’ top and bottom-line, it is virtually impossible to fathom that DraftKings was and continues to remain unaware of its ongoing relationship with BTi/CoreTech and its illicit operators.

Yet rather than disclose anything about these relationships, the company instead appears to have created a complex web of misinformation to conceal them.

The 2016 New Jersey Division of Gaming Authority’s director´s bulletin, which serves as a key reference document for other U.S. gambling regulators, stressed the importance of “good character, honesty and integrity” of its licensees and/or prospective licensees.

The U.S. online gambling industry is in its infancy. It is still in the process of proving to the public that online gaming operators can act responsibly and ethically.

Based on our findings, we urge DraftKings to release a full and transparent third-party audit, not only of its relationship with BTi/CoreTech, but also of the revenue streams – by geographic location and customer – that all of its “reseller” entities and related parties are funneling up to the DraftKings public entity.

Appendix A: Additional Links to Suspected Black Market Operators

We are open sourcing one of our techniques for identifying suspected black market brands associated with BTi/CoreTech in case others wish to further understand or pursue the issues.

Early on in our investigation we found a Thai and Chinese language Betway mirror with an API referencing BTi, that resolved to this domain – Apitw.btisports.io. (The specific Betway mirror disappeared following a massive alleged illegal gaming ring was raided in Thailand.) Below is a screenshot showing the Betway branded mirror site which was accessed at BIWEI88INTW.COM.

We then ran a search for subdomains of bitsports.io in a database called RiskIQ Passivetotal, a web intelligence operator that tracks online infrastructure.

From there, we found subdomains for sports betting sites linked to over 25 operators who appear to be targeting black market clientele, based on the languages supported. Jurisdictions where gambling is illegal include China, Vietnam, Thailand, Indonesia and Korea.

Most sites had BTi branding, along with source code that shared the same labeling system as SBTech’s. We accessed each subdomain using a VPN through jurisdictions like Thailand, China and Vietnam.

| Btisports.Io Subdomains Linked To Suspected Black Market Clientele | ||

| Hostname | Brand | Languages supported |

| manbetx.btisports.io | Man Bet X | English and Chinese |

| tlcasia.btisports.io | TLCBet | English and Chinese |

| m88bsports.btisports.io | Mansion 88 (aka M88) | English, Chinese, Vietnamese, Indonesia, Thai, Korean |

| kzingf88inr.btisports.io | Fun88 | |

| 12bet.btisports.io | 12Bet | |

| bw88sl.btisports.io | Betway | English, Chinese and Thai |

| bttt1t002.staging.btisports.io | SOS 188 | English, Chinese and Thai |

| 1bet2u.btisports.io | 1bet2u | English, Chinese, Vietnamese, Indonesia, Thai |

| ag88.btisports.io | BIYOU international | English Chinese |

| bttt1t002.btisports.io | SOS 188 | English, Chinese, Vietnamese, Indonesia, Thai, Korean |

| gamma1.btisports.io | SOS 188 | English, Chinese, Vietnamese, Indonesia, Thai, Korean |

| fb88bet.btisports.io | FB88 | English, Chinese, Vietnamese, Indonesia, Thai |

| lvksports.btisports.io | LVK Sports | English, Chinese, Vietnamese, Indonesian, Thai |

| r11ekbet.btisports.io | SOS 188 | English, Chinese, Vietnamese, Indonesia, Thai , Japanese, Korean |

| r11ekbet2.btisports.io | Unknown | English, Chinese, Vietnamese, Indonesia, Thai , Japanese, Korean |

| slotgame66.btisports.io | Slotgame6666 | English, Chinese, Vietnamese, Indonesia, Thai , Japanese, Korean |

| superswan.btisports.io | Super Swan | English, Chinese, Vietnamese, Indonesia, Thai , Japanese, Korean |

| tcgaming.btisports.io | TC Gaming | English, Chinese, Vietnamese, Indonesia, Thai , Japanese, Korean |

| xbetgroup.btisports.io | XbetGroup | English, Chinese, Vietnamese, Indonesia, Thai , Japanese, Korean |

| yongbao.btisports.io | Yongbao | English and Chinese |

| mile88.btisports.io | Unknown | English and Chinese |

| opinr01.btisports.io | Unknown | English and Chinese |

| n2ohstq.btisports.io | Unknown | English and Indonesian |

| r01deltin.btisports.io | Unknown | English, Chinese, Vietnamese, Indonesia, Thai , Japanese, Korean |

| r01deltin2.btisports.io | Unknown | English, Chinese, Vietnamese, Indonesia, Thai , Japanese, Korean |

| zf0039.btisports.io | Unknown | English, Chinese, Vietnamese, Indonesia, Thai , Japanese, Korean |

| rk8vn.btisports.io | Unknown | Vietnamese and Chinese |

| rks.btisports.io | Unknown | Chinese |

| techplay.btisports.io | Unknown | English and Vietnamese |

| zlsport.btisports.io | Unknown | Chinese |

| rks.staging.btisports.io | Unknown | Chinese |

Disclosure: We are short shares of DraftKings, Inc. (NASDAQ:DKNG)

Legal Disclaimer

Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that as of the publication date of any short-biased report or letter, Hindenburg Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Following publication of any report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein.

[1] Note that in a report by the Oregon state lottery that we received through a public records request, two SBTech reseller entities were named: BTi and W88. Per the report, the resellers collectively “account for over 99% of the revenue which SBTech derives from gambling services being provided to end users in China.” At the time, China was classified as a “grey” market by the regulator, which it defined as a jurisdiction where gambling was illegal but where the laws were not actively being enforced. Oregon chose to permit the behavior. Since then, China has arrested over 11,500 people for gaming offenses. [Pg. 11]

[2] SpotOption claimed it hadn’t been raided but U.S. court records reveal the FBI “seized” SpotOption’s records through an onsite search warrant [Pg. 3]

[3] Note that Betway recently announced plans to go public via a $5 billion SPAC deal. Incidentally, Betway’s European brand also appears to be powered by SBTech.

[4] Data cited from Eilers & Krejcik U.S. Sports Betting Market Monitor report, dated May 2021